The Sunday Recap – Down the Rabbit Hole 16

As usual, the cryptoverse threw up more than its fair share of interesting and in some cases, downright exciting, developments. Price threatened to rally then decided to bide its time for a while yet. Institutional money finally makes an appearance in the market, a shot across the bow of the bear perhaps? The SEC hints at soon to be announced regulatory clarity for the crypto industry. Bitcoins monthly chart shows a very interesting pattern. The managing director of Co-Venture gives us a peek into his trading mindset. A developer unpacks Cardano and finds a lot to like. Perhaps most interestingly of all, LiquidApps may have unlocked scaling for EOS.

The story behind how a crypto venture fund landed two pension funds as investors:

https://twitter.com/APompliano/status/1095477434076540928

BTC analysis that sees a drop to year lows mid-year before a rebound:

https://twitter.com/MustStopMurad/status/1092944080156405760

A hint of regulatory clarity from the SEC:

https://twitter.com/Atomic_Capital/status/1094726226219073536

So this guy is bullish, are you?

https://twitter.com/TraderScarface/status/1094780212489871366

Does Twitter and by extension social media actually act to stifle big ideas? (I think no, but worth a moment of reflection.):

https://twitter.com/paulg/status/1068456166693441537

A man who knew a thing or two:

https://twitter.com/ProfFeynman/status/1093534576679489536

A bit of lighthearted investment wisdom:

https://twitter.com/RampCapitalLLC/status/1095766051592249345

Articles

BTC network security may face real issues in the coming years and some possible solutions (highly recommended):

https://www.theblockcrypto.com/2019/01/24/bitcoin-post-issuance-an-existential-threat/

An interesting analysis of BTC trading levels (put your chart googles on):

https://mentormarket.io/cryptocurrencies/bit-brain/bitcoin-fib-levels/

A survey of blockchain use cases (forgive the self-promotion):

https://trybe.one/use-cases-for-blockchain/#comment-66474

Excellent monthly comparison of EOS, ETH, Tron across a range of metrics:

https://trybe.one/eos-vs-eth-vs-trx-dapp-usage-january-2019/#comment-67720

Big bank, big plans and targeted at the right market:

https://www.coindesk.com/japans-biggest-bank-launching-blockchain-payments-network-in-2020

China’s monetary policy may prove a boon for BTC:

Podcast

If you are trading crypto – and want to hear from one of the best in the business:

https://itunes.apple.com/au/podcast/ateet-ahluwalia-managing-director-coventure-inside/id1434060078?i=1000428778709&mt=2

Youtube

The monthly chart of Bitcoin shows a very interesting pattern:

A developers review of Cardano – balanced and knowledgeable (recommended):

Bitcoin and Litecoin Four Year Supercycle analyzed:

Did LiquidApps just change the EOS state of play? (highly recommended):

Infographic

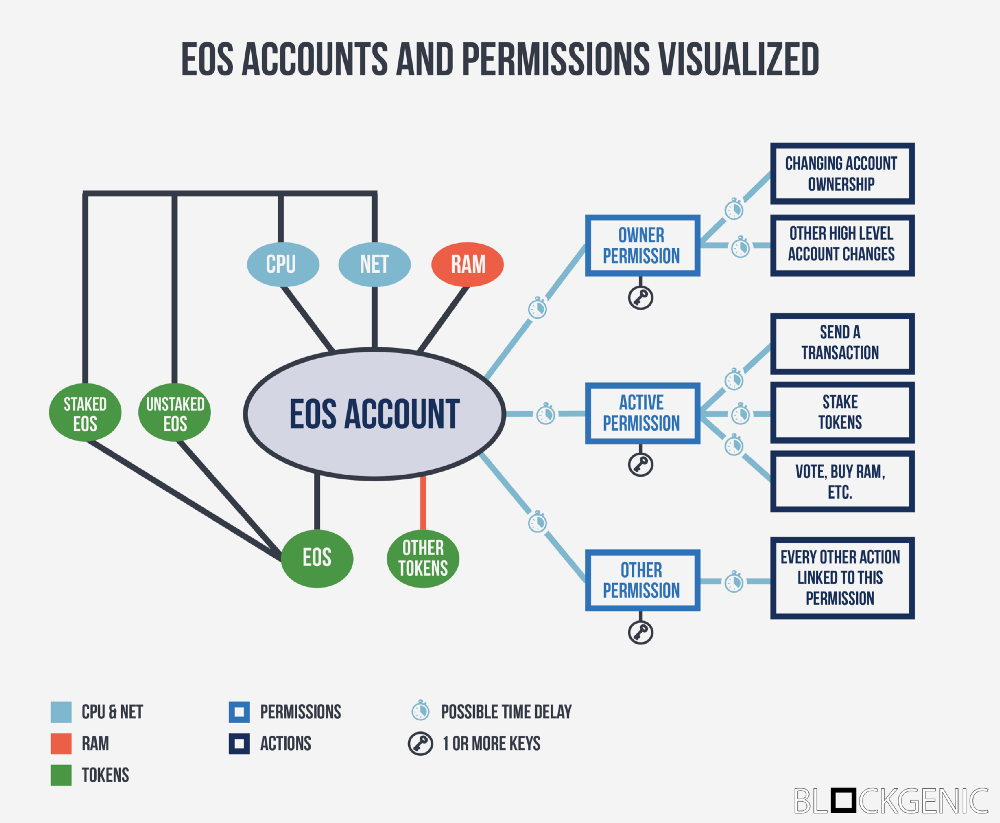

Adding a bit of visual clarity to EOS account permissions:

https://medium.com/coinmonks/eos-accounts-and-permissions-visualized-677fc9c144e4

So the bear trend remains firmly in place and ultimately shows few tangible signs of running out of steam. However, while we await sunnier developments in the broader market, the fundamentals of crypto grow ever more solid. Many projects may be on the way out but the key players show resilience and continual tech improvements. There’s a lot to like out there and far more to learn! As usual, looking forward to your comments and reflections.

Note on Sources:

Twitter & Reddit (cryptos current meta-brains) / Medium / Trybe / Hackernoon / Whaleshares / TIMM and so on/ YouTube / various podcasts and whatever else I stumble upon. The aim is a useful weekly aggregator of ideas rather than news. Though I try to keep the sources current – I’ll reference these articles and podcasts etc. as I encounter them – they may have been published just a couple of days ago or in some cases quite a bit earlier.

The dividers in this post were licensed by @calumam under a Creative Commons Attribution 4.0 International License.

Your opinion is celebrated and welcomed, not banned or censored!